×

IICOMBINED

IICOMBINED famously known for a global eyewear brand Gentle Monster took the first FI investment with us. Through this, IICOMBINED smoothly entered the financial investment scene. In accordance with expiration of fund duration, we made a successful exit.

×

TEMC

From pre-A stage investment to listing in KOSDAQ, we had worked as a proactive consultant coming with numerous tactics and strategies. Especially in the process of being listed, we had provided detailed consulting related to corporate image making and financials. Upon listed, we possessed more than 7% of ownership leading to achieving high TVPI.

×

STANDARD ENERGY

Without initial financial support from accelerators, we were able to commit first investment at pre-A stage, followed by our follow-on investment. During technology development stage, we provided strategic consulting for its multi-dimensional growth. Standard Energy is expected to grow as a new paradigm in the secondary battery industry.

×

shaperon

샤페론 관련 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가합니다. 디테일 하게 내용을 추가.

×

KONG STUDIOS

Facilitating active collaboration among domestic and overseas VCs, we were able to bring in a substantial amount of collective investment at early stage. Through this, Kong Studios was able to successfully launch global IP “Guardian Tales”. We are working closely with Kong Studios for it to evolve into a major video game developer that can produce triple-A games.

×

KRAFTON

We sourced Krafton at the very early stage with a substantial amount of investment. Being a partner throughout the journey to becoming a decacorn, we helped designing the value-up creation model by proactively participating in establishing an effective M&A strategy. Krafton was listed in KOSPI at the market-cap of $20B where we were the 4th largest shareholder with more than 5% ownership at hand, leading to one of the most successful VC investment in the history of South Korea.

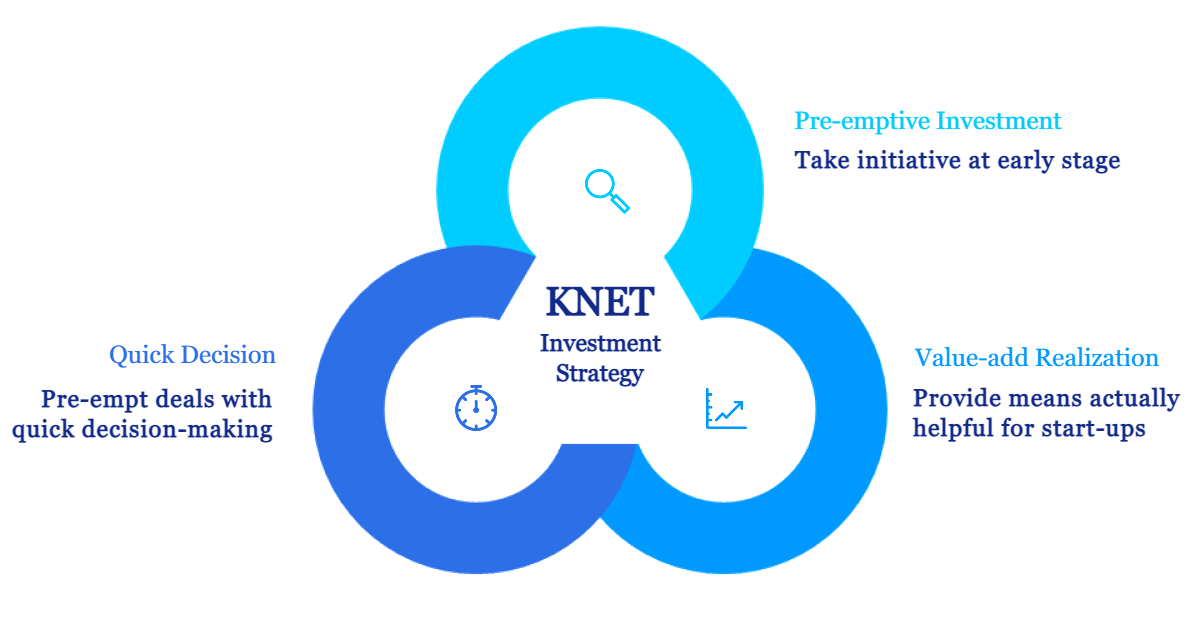

Why We Are Different

People

Dae-young Kim

President / Ph.D

- KRX KOSDAQ Market Committee

- Korea Technology Investment

- Doosan Group

- LG Investment & Securities

- Ph.D, Business Administration, Sungkyunkwan Univ.

- MBA, New York Univ. Stern School of Business

- BA, Public Administration, Korea Univ.

Hee-charng Kim

Executive Director / Partner

- DY Investment

- Korea Technology Investment

- Bachelor of Economics, Sogang Univ.

Sang-hoon Lee

Executive Director / Partner / Ph.D

- Korea University Holdings

- London Capital Advisors

- Korea Technology Exchange

- Samsung Electronics

- Ph.D, Mechanical Engineering, University of Texas at Austin

- MS, Mechanical Engineering, University of Texas at Austin

- BS, Mechanical Engineering, Korea Univ.

Dae-hwa Jung

Director / CPA, CFA

- LINEA Investment

- Federal Home Loan Banks

- Sumitomo Mitsui Banking Corporation

- Samil PwC

- MS, Applied Economics, Johns Hopkins Univ.

- MBA, Indiana Univ. Kelley School of Business

- BA, Business, Sungkyunkwan Univ.

Myung-kwan Kim

Manager

- TS Investment

- BA, Economics, Emory Univ.

Chang-mook Lee

Associate

- Deloitte consulting

- PwC consulting

- BS, Materials Science and Engineering, Korea Univ.

Ju-han Yun

Associate

- Tikitaka Solution co-founder

- BS, Industrial and Management Engineering, Korea Univ.

Jin-hee Choi

Manager

- Hansong TAX

Hye-in Kwon

Assistant Manager

- Korea E&C Architects Office

- BS, Corporate Management, Kookmin Univ.